Best Way To Make Money In The Philippines

Compare the best money transfer rates to Philippines

At Wise, we never hide extra fees and charges in the exchange rate. We just use the exchange rate – independently provided by Reuters. That means fair, low-cost transfers, every time.

Compare Wise exchange rates and fees with some of the biggest money transfer and remit services, such as Barclays, MoneyGram or WorldRemit.

Start saving now

How to send money to Philippines in 3 easy steps

1

Start your transfer.

Pay in GBP with your debit card or credit card, or send the money from your online banking.

2

Get the best rate out there.

Wise always gives you the real and fair mid-market exchange rate.

3

Money is locally delivered.

The recipient gets money in their currency directly from Wise's local bank account.

How much does it cost to transfer money to Philippines?

To send money in GBP to Philippines, you pay a small, flat fee of 0.56 GBP + 0.45% of the amount that's converted (you'll always see the total cost upfront).

Some payment methods have an added fee, but that's usually tiny too.

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

| Wise Fees | |

|---|---|

| Fixed fee | 0.56 GBP |

| % fee for transfers up to 100,000 GBP | 0.45% |

| % fee for transfers up to 300,000 GBP | 0.35% |

| % fee for transfers up to 500,000 GBP | 0.3% |

| % fee for transfers up to 1,000,000 GBP | 0.29% |

| % fee for amounts over 1,000,000 GBP | 0.28% |

How long will a money transfer to Philippines take?

On many popular routes, Wise can send your money within one day, as a same day transfer, or even an instant money transfer.

Sometimes, different payment methods or routine checks may affect the transfer delivery time. We'll always keep you updated, and you can track each step in your account.

Your transfer route

Should arrive

by November 23rd

Save when sending money to Philippines

Wise is easy

How to send money to Philippines from the United Kingdom

Wise makes transferring money to Philippines a breeze:

- Just tap in how much, and where to.

- Then make a local payment to Wise, whether it's with a bank transfer, swift or your debit or credit card.

- And that's it.

Wise converts your money at the 'inter-bank' rate – the real rate – so you save big time (even versus the guys saying there's 'zero' commission). On Wise, there's no room for sneaky bank surcharges or creeping hidden charges.

Available payment methods

- Bank Transfer

- Debit Card

- Credit Card

- PISP

- Swift

The best ways to send money to Philippines

Choosing the right way to send money with Wise will largely depend on your payment method. Some payment methods are faster than others. Some can be instant, while others are cheaper.

Here are the best ways to transfer money to Philippines with Wise:

-

Bank Transfer

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option here.

-

Debit Card

Paying for your transfer with a debit card is easy and fast. It's also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card here.

-

Credit Card

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card here.

-

PISP

PISP (Payment Initiation Service Provider) payments are instructions you give Wise to make a bank transfer directly from your bank account — without having to leave our app and log in to your online banking. This option is as cheap as a manual bank transfer, but it isn't supported by all banks yet.

-

Swift

Using SWIFT to fund your transfer usually means that your transfer will take longer and be more expensive, as your bank will charge a fee. You should also bear in mind that other correspondent banks in between may also deduct their handling fees. Your bank should be able to advise on those fees.

What you'll need for your online money transfer to Philippines

-

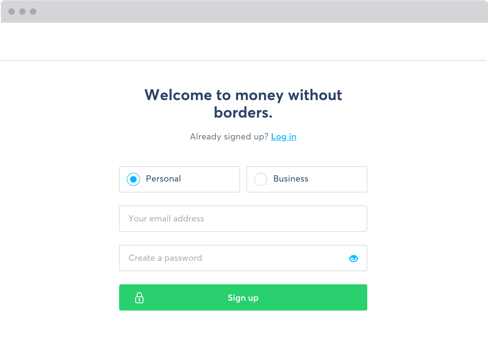

1. Create your free account.

Click 'Sign up', then create your free account. It takes seconds. You can do it on our website or with our app. All you need is an email address, or a Google or Facebook account.

-

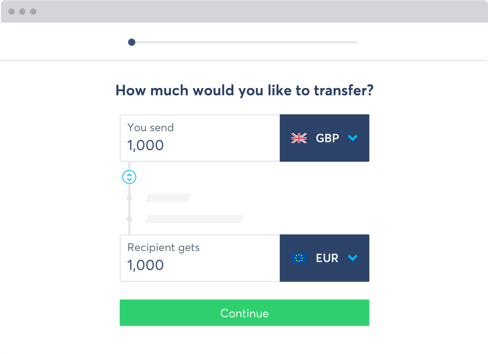

2. Set up your first transfer.

Use our calculator to tell us how much money you want to send, and where you want to send it. You'll see our fees upfront. We'll tell you when your money should get there, too.

-

3. Tell us a little about yourself.

We'll ask you if you're sending money as an individual or business. We'll also need your full name, birthday, phone number, and address. You know, the standard stuff.

-

4. Tell us who you're sending to.

Yourself? Someone else? A business or charity? Pick your answer. Then we'll ask you for some basic information about your recipient, including their bank details. They need a bank account, but they don't need a Wise account. (Though we hope they'll want one soon.)

-

5. Make sure everything looks good.

We'll show you a summary of your transfer. If everything looks good, click Confirm. You can also make any changes you need to.

-

6. Pay for your transfer.

Would you like to pay by bank transfer? Debit or credit card?Make your choice, and we'll tell you how to do it. Each payment method has its own steps, but they're all straightforward and should only take a few minutes.

Wise is safe and secure

Wise is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

This means we're required by law to keep your money safe by storing it in a low-risk financial institution - in Europe this is in our UK account with Barclays, in the US this is in our US account with Wells Fargo.

We're trusted by 10 million people and counting.

We have a 4.6 out of 5 rating on Trustpilot

It's your money. You can trust us to get it where it needs to be, but don't take our word for it. Read our reviews at Trustpilot.com

The best way to transfer money!! No doubt!!

Ioan

Published 17 hours ago

Excellent! Easy to use! Fast! Economical!

Bill W

Published 19 hours ago

efficient and reliable

Dan h

Published 21 hours ago

Save money when sending money to Philippines

Transfer your British pound to Philippine peso today with Wise.

Create free account now

FAQs

Choosing the right way to send money with Wise will largely depend on your payment method. Some payment methods are faster than others. Some can be instant, while others are cheaper. Find out here what are the best ways to transfer money to Philippines with Wise.

Yes. Wise is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the United Kingdom. Learn more

Yes, there are limits for how much you can send to Philippines with us. They depend on which currencies you send to and from, and how you pay. You can check the limits for each currency in our help center articles or in our calculator. We'll also let you know if you try to send too much at one time.

If you'd like to send more than our limits allow, you can. You'll just need to set up several transfers that are under the limits.

On many popular routes, Wise can send your money within one day, or even within seconds. Sometimes, different payment methods or routine checks may affect the transfer delivery time. We'll always keep you updated, and you can track each step in your account.

See how long a money transfer to Philippines takes.

- Register for free

Sign up online or in our app for free. All you need is an email address, or a Google or Facebook account. - Choose an amount to send

Tell us how much you want to send. We'll show you our fees upfront, and tell you when your money should arrive. - Add recipient's bank details

Fill in the details of your recipient's bank account. If you don't know their details, we can request them for you. - Verify your identity

For some currencies, or for large transfers, we need a photo of your ID. This helps us keep your money safe. - Pay for your transfer

Send your money with a bank transfer, or a debit or credit card. - That's it

We'll handle the rest. You can track your transfer in your account, and we'll tell your recipient it's coming.

Best Way To Make Money In The Philippines

Source: https://wise.com/gb/send-money/send-money-to-philippines

Posted by: floydandised.blogspot.com

0 Response to "Best Way To Make Money In The Philippines"

Post a Comment