Best Way To Invest Money Right Now

What to Invest In

Updated: Nov. 1, 2021, 10:32 a.m.

Building wealth underpins the American dream. Whether it's paying for a kid's education, securing a comfortable retirement, or attaining life-changing financial independence, what you invest in plays a huge role in your success. It's not just about picking winning stocks, or stocks vs. bonds, either. It's truly making appropriate investment decisions based on your goals. Or more specifically, when you will be relying on the proceeds from your investments.

Let's take a closer look at some of the most popular investment vehicles. They may not all be appropriate for you today, but over time, the best investments for your needs can change. Let's dig in.

- Stocks

- Bonds

- Real estate

- Tax-advantaged accounts, such as retirement accounts

Why stocks are good investments for almost everyone

Almost everyone should own stocks. That's because stocks have consistently proven the best way for the average person to build wealth over the long term. U.S. stocks have delivered better returns than bonds, savings yields, and gold over the past four decades. Stocks have outperformed most investment classes over almost every 10-year period in the past century.

Why have U.S. stocks proven such great investments? Because as a stockholder, you own a business; as that business gets bigger and more profitable, and as the global economy grows, you own a business that becomes more valuable. In many cases, shareholders also earn a dividend.

We can use the past dozen years as an example. Even across two of the most brutal recessions in history, the SPDR S&P 500 ETF (NYSEMKT:SPY), an excellent proxy for the stock market as a whole, has delivered better returns than gold or bonds:

This is why stocks should make up the foundation for most people's portfolios. What varies from one person to the next is how much stock makes sense.

For example, someone in their 30s saving for retirement can ride out many decades of market volatility and should own almost entirely stocks. Someone in their 70s should own some stocks for growth; the average 70-something American will live into their 80s, but they should protect assets they'll need in the next five years by investing bonds and holding cash.

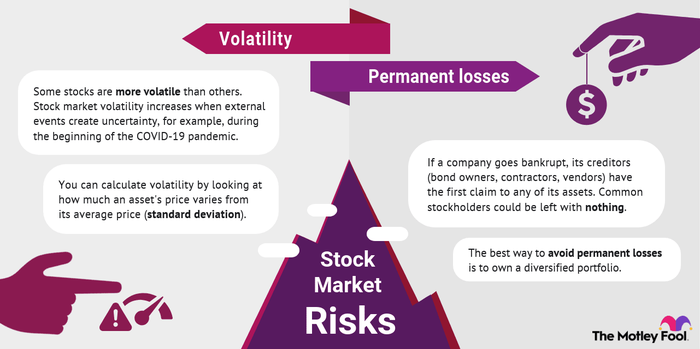

There are two main risks with stocks:

- Volatility: Stock prices can swing broadly over very short periods. This creates risk if you need to sell your stocks in a short period of time.

- Permanent losses: Stockholders are business owners, and sometimes businesses fail. If a company goes bankrupt, bond owners, contractors, vendors, and suppliers stand to get repaid first. Stockholders get whatever -- if anything -- is left.

You can limit your risk to the two things above by understanding what your financial goals are.

Managing volatility

If you have a kid heading off to college in a year or two, or if you're retiring in a few years, your goal should no longer be maximizing growth -- instead, it should be protecting your capital. It's time to shift the money you'll need in the next several years out of stocks, and into bonds and cash.

If your goals are still years and years in the future, you can hedge against volatility by doing nothing. Even through two of the worst market crashes in history, stocks delivered incredible returns for investors who bought and held.

Avoiding permanent losses

The best way to avoid permanent losses is to own a diversified portfolio, without too much of your wealth concentrated in any one company, industry, or end market. This diversification will help limit your losses to a few bad stock picks, while your best winners will more than make up for their losses.

Think about it this way: If you invest the same amount in 20 stocks and one goes bankrupt, the most you can lose is 5% of your capital. Now let's say one of those stocks goes up 2,000% in value, it makes up for not just that one loser, but would double the value of your entire portfolio. Diversification can protect you from permanent losses and give you exposure to more wealth-building stocks.

![]()

Why you should invest in bonds

Over the long term, growing wealth is the most important step. But once you've built that wealth and get closer to your financial goal, bonds, which are loans to a company or government, can help you keep it.

There are three main kinds of bonds:

- Corporate bonds, issued by companies.

- Municipal bonds, issued by state and local governments.

- Treasury notes, bonds, and bills, issued by the U.S. government.

Here is a recent example of how bonds can be useful investments, using the Vanguard Total Bond Market ETF (NYSEMKT:BND), which owns short- and long-term bonds, and the iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY), which owns the most stable treasury bonds, compared to the SPDR S&P 500 ETF Trust:

As the chart shows, while stocks were crashing hard and fast, bonds held up much better, because a bond's worth -- the face value, plus interest promised -- is easy to calculate, thus far less volatile.

As you get closer to your financial goals, owning bonds that match up with your timeline will protect assets you'll be counting on in the short term.

Stocks

Research companies and invest in individual stocks.

Index funds

Invest in index funds for a more passive approach, compared to buying individual stocks.

Bonds

Invest in bonds for predictable, more stable returns.

Retirement accounts

Grow your money over long periods of time, either passively or actively.

Why and how to invest in real estate

Real estate investing might seem out of reach for most people. And if you mean buying an entire commercial property, that's true. However, there are ways for people at almost every financial level to invest in and make money from real estate.

Moreover, just like owning great companies, owning high-quality, productive real estate can be a wonderful way to build wealth, and in most recessionary periods throughout history, commercial real estate is counter-cyclical to recessions. It's often viewed as a safer, more stable investment than stocks.

Publicly traded REITs, or real estate investment trusts, are the most accessible way to invest in real estate. REITs trade on stock market exchanges just like other public companies. Here are some examples:

- American Tower (NYSE:AMT) owns and manages communications sites, primarily cell phone towers.

- Public Storage (NYSE:PSA) owns almost 3,000 self-storage properties in the U.S. and Europe.

- AvalonBay Communities (NYSE:AVB) is one of the largest apartment and multifamily residential property owners in the U.S.

REITs are excellent investments for income, since they don't pay corporate taxes, as long as they pay out at least 90% of net income in dividends.

It's actually easier to invest in commercial real estate development projects now than ever. In recent years, legislation made it legal for real estate developers to crowdfund capital for real estate projects. As a result, billions of dollars of capital has been raised from individual investors looking to participate in real estate development.

It takes more capital to invest in crowdfunded real estate, and unlike public REITs where you can easily buy or sell shares, once you make your investment you may not be able to touch your capital until the project is completed. Moreover, there's risk that the developer doesn't execute, and you can lose money. But the potential returns and income from real estate are compelling, and have been inaccessible to most people until recently. Crowdfunding is changing that.

Invest in brokerage accounts that reduce taxes

Just as owning the right investments will help you reach your financial goals, where you invest is just as important. The reality is, people don't consider the tax consequences of their investments, which can leave you short of your financial goals.

Simply put, a little bit of tax planning can go a long way. Here are some examples of different kinds of accounts you may want to use on your investing journey. In each of these accounts—except for a taxable brokerage—your investments grow tax free..

| Investing Account Type | Account features | Need to know |

|---|---|---|

| 401(k) | Pre-tax contributions reduce taxes today. Potential employer-matching contributions. | Distributions in retirement are taxed as regular income. Penalties for early withdrawal. $19,500 employee contribution limit in 2020. |

| SEP IRA/Solo 401(k) | Pre-tax contributions reduce taxes today. Higher contribution limits than IRAs. | Distributions in retirement are taxed as regular income. Penalties for early withdrawal. $57,000 total contribution limit in 2020. |

| Traditional IRA | Use to rollover 401(k) from former employers. Contribute retirement savings above 401(k) contributions. | Distributions in retirement are taxed as regular income. Penalties for early withdrawal. $6,000 contribution limit in 2020. |

| Roth IRA | Distributions are also tax free in retirement. Withdraw contributions penalty free. | Contributions are not pre-tax. Penalties for early withdrawal of gains. Contribution limits determined by your income. |

| Taxable brokerage | Contribute any amount to your account without tax consequences (or benefits). Withdraw money at any time. | Taxes are based on realized events (even if you don't withdraw proceeds), i.e. you may owe taxes on realized capital gains, dividends, and taxable distributions . |

| Coverdell ESA | More control over investment choices. Withdrawals for qualified education expenses are tax free. | $2,000 annual contribution limit; further limits based on income. Taxes and penalties for nonqualified withdrawals |

| 529 College Savings | Withdrawals for qualified education expenses. Very high contribution limits. | More complicated, varying by state. Fewer investment choices. Taxes and penalties for nonqualified withdrawals. |

The biggest takeaway here is that you should choose the appropriate kind of account based on what you're investing for. For instance:

- 401(k) – For employed retirement savers

- SEP IRA/Solo 401(k) – For self-employed retirement savers

- Traditional IRA – For retirement savers

- Roth IRA – For retirement savers

- Taxable brokerage – For savers with additional cash to invest beyond retirement/college savings account needs or limits

- Coverdell ESA – For college savers

- 529 College Savings – For college savers

Here are some more points to keep in mind, based on why you are investing:

- Maximize employer-based 401(k) plans, at least up to the maximum amount your employer will match, is a no-brainer.

- If your earnings allow you to contribute to a Roth IRA, building up tax-free income in retirement is an excellent way to help secure your financial future.

- Use the Roth-like benefits of the Coverdell and 529 college savings plans removes the tax burden, resulting in more cash to pay for education.

- A taxable brokerage account is an excellent tool for other investing goals, or extra cash above retirement account limits.

The bottom line is that everyone's situation is different. You must consider your investment time horizon, desired return, and risk tolerance to make the best investment decision to reach your financial goals.

Recent articles

IPO Stock Udemy's Profit Margins Are Better Than They Look

The company has the financial profile investors have come to love with marketplace businesses.

Jon Quast | Nov 10, 2021

Could This Risk Impact AppLovin Stock in the Short Term?

Changes in the advertising technology industry could impact the value of AppLovin's recent acquisitions.

Jon Quast | Nov 10, 2021

General Electric's Breakup Should Help GE Stock

One of the best-known conglomerates in the world is splitting itself up.

Adam Levine-Weinberg | Nov 10, 2021

Starbucks is Mixing Coffee With Crypto

The popular consumer brand is showing off its forward-thinking mentality.

Neil Patel | Nov 10, 2021

The 2021 Stock Market Is Quietly Breaking a Record in This Specific Category

When money is this easy to come by, it's important to watch out for companies that are coming public but aren't good investment opportunities.

Jon Quast, Travis Hoium, and Danny Vena | Nov 10, 2021

Why Shopify Stock Is Still a Smart Buy

This innovative e-commerce company continues to impress Wall Street.

Trevor Jennewine, Brian Withers, and Nicholas Rossolillo | Nov 10, 2021

Foreclosures Are Down Despite Moratoriums and Pandemic Concerns

Experts were predicting a flood of foreclosures after the expiration of moratoriums. But data show that's far from the case. Here's how it affects real estate investors.

Liz Brumer-Smith | Nov 10, 2021

Will Nvidia Be Worth More Than Apple by 2026?

Both tech giants have solid catalysts, but one of them could grow at a faster pace than the other.

Harsh Chauhan | Nov 10, 2021

Disney+ Day: Deals and Park Perks and NFTs, Oh, My!

The popular streaming service turns 2 on Friday, and the media giant is celebrating up and down its ecosystem.

Rick Munarriz | Nov 10, 2021

2 Top Growth Stocks to Buy Right Now Without Any Hesitation

These fundamentally strong stocks can generate huge returns in the coming years.

Manali Bhade | Nov 10, 2021

You might like:

Best Way To Invest Money Right Now

Source: https://www.fool.com/investing/how-to-invest/what-to-invest-in/

Posted by: floydandised.blogspot.com

0 Response to "Best Way To Invest Money Right Now"

Post a Comment